The week ahead comes at you earlier on Sunday this week than usual, as we prepare to celebrate Rosh Hashanah. L’Shana Tova to all who celebrate!

More Mar-a-Lago ahead this week. There will also be a January 6 committee hearing (the last one?) on Wednesday.

The hearing isn’t in prime time, which makes me think it won’t be a barn burner. If this was a true coup de grâce, I think we’d see the networks prioritize it. And, there are rumors of committee staff already lining up their next jobs, even though the reports still need to be written. But these hearings have always delivered up until now, so I’ll remain cautiously optimistic.

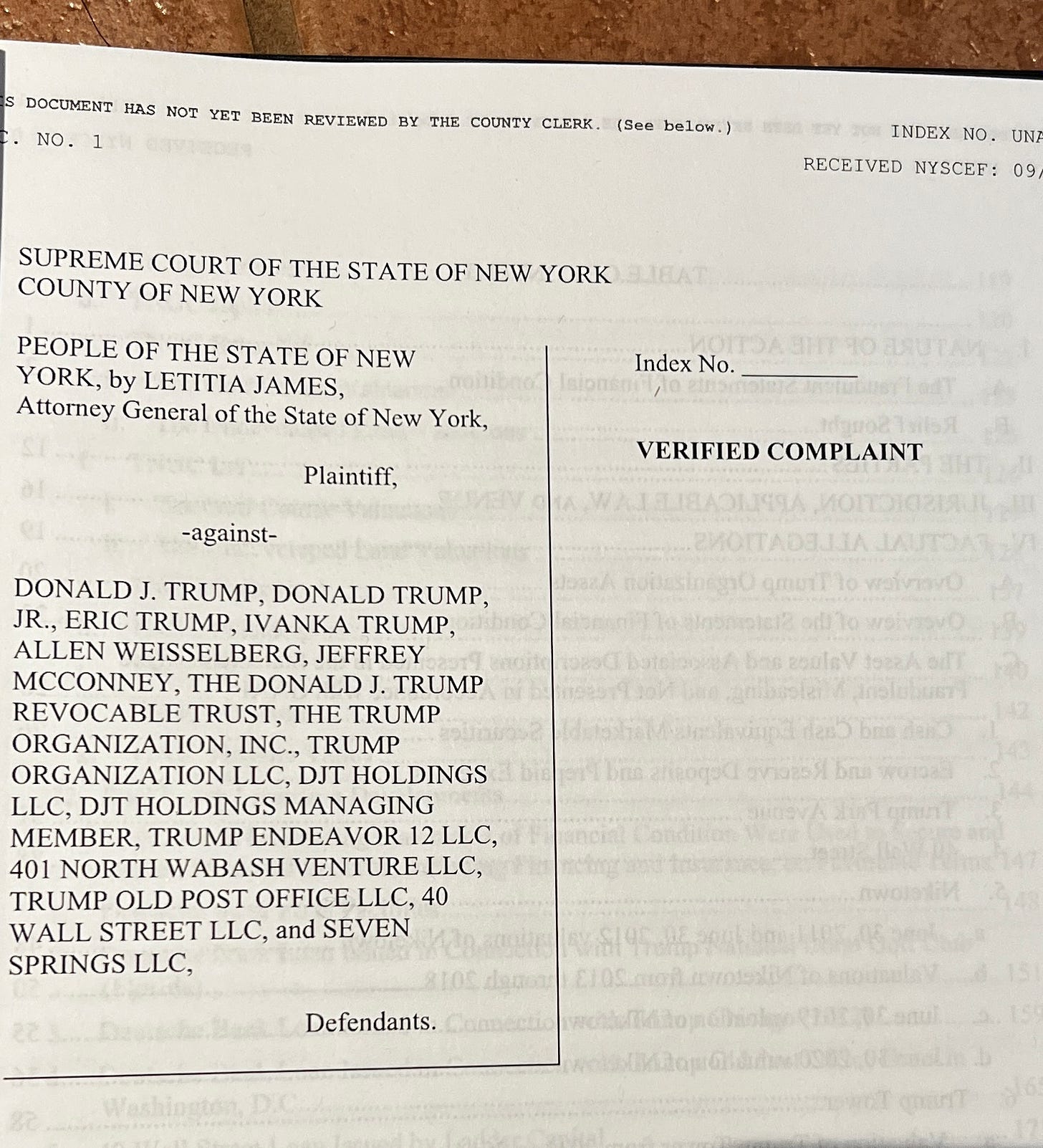

I want to devote most of our time today to the civil lawsuit New York Attorney Leticia James filed last week. This one is a barn burner. James brought the receipts, alleging she would establish 200 incidents of fraud. The photo is the caption of the case. You can see that there are a number of defendants, both corporations and individuals. The lawsuit is so lengthy that it’s uploaded in two different segments, part one and part two. It’s over 800 pages including exhibits.

Even though this isn’t a criminal case, James can do significant damage to the former president’s business and financial stability—and if she proves her case, perhaps even to the myth of his business acumen. Sure, no one is going to jail, but because it’s a civil case, not a criminal one, the burden of proof is lower. While a criminal case requires proof beyond a reasonable doubt, in a civil case, a preponderance of the evidence suffices.

Trump took the 5th Amendment when he was questioned by James this summer. While that may have hurt the criminal investigation, in a civil case, it can be used as evidence against him. This is a big difference from a criminal case, where it can’t be mentioned in front of the jury. That’s going to be very helpful to James as the case proceeds, and there’s every sense it will. She turned down a settlement offer from Trump’s lawyers before it was filed.

The lawsuit alleges that from 2011-2021, Donald Trump, with the help of Don Jr., Ivanka, and Eric, as well as two senior executives, CFO Allen Weisselberg (who has already pleaded guilty to criminal charges), and some of his corporate entities falsely inflated Trump’s net worth by billions of dollars to induce banks to lend money to the Trump Organization on more favorable terms than they could have gotten if they’d been truthful. Then, they turned around and decreased the valuations to minimize tax obligations. There’s a lot more detail to it, but that’s the core of the allegations. Attorney General James’ lawsuit is brought under a New York state law that permits her to protect New Yorkers from companies that engage in “persistent fraud or illegality in the carrying on, conducting or transaction of business.”

If James’ lawsuit is successful, the results would be catastrophic for Trump. Although she’s not seeking a full on corporate death penalty like she did when she terminated Trump’s charitable foundation, she will ask the court to:

permanently bar Trump and the three adult children from his first marriage from serving as officers or directors in any New York business entity registered/licensed in New York state

bar Trump and the Trump Organization from entering into any New York real estate acquisitions for five years

order Trump to return his ill-gotten gains, which means Trump would have to pay the state close to $250 million

The Attorney General has also made criminal referrals to the U.S. Attorney’s Office for the Southern District of New York and the Internal Revenue Service (IRS) for criminal investigation. Could DOJ consider another criminal investigation into Trump’s misconduct? Before we get too excited about this possibility, DOJ has known about this situation for some time and it’s not clear there’s anything new here that would light a fire under them if they haven’t already investigated and considered this matter for prosecution. Nonetheless, the complaint lays out a serious possible tax fraud case and if the evidence establishes that Trump willfully underpaid his taxes, there’s no reason he should get a break, even if prosecution comes a little late.

If I can sound petty for a moment, it constantly annoys me that three adults in their 30’s and 40’s with children of their own, are referred to as the former president’s “children.” It’s as though that somehow makes them less culpable for their misconduct. These are people who’ve made multi-million dollar business deals and in Ivanka’s case, served as a senior advisor to the president of the United States. They are not children. They should be held responsible for their own actions.

Here are five items that have caught my attention as I’ve read the complete. I’m flagging them here and we can see how they play out as the case proceeds:

1. Watch the alignment of defense counsel in this case. Trump is represented by a different set of lawyers than the “kids,” who are all represented by Allen Fuertas. Fuertas specializes in criminal defense work and white collar crime. Interesting aside, while in law school, he worked for Jay Goldberg, the lawyer who represented the former president in his first two divorces. Allen Weisselberg and Jeff McConney (the Trump Organization comptroller) are each represented separately, by two different law firms. The corporate entities share Trump lawyer Alina Habba, but are also represented by an additional law firm, shared by all three. Sometimes, we can learn a little bit about who is considering settling a case if changes are made in counsel. For instance, Don Jr., Ivanka, and Eric are all represented by the same lawyers right now, suggesting a commonality of interests. If one of them breaks ranks, that would be interesting. And still pending is the criminal trial for Trump Organization, scheduled for October. The judge in that case has signaled he is not interested in any delay. The evidence in that case might drive a wedge between the co-defendants here, which could surface in the form of changing lawyers. And, lurking in the background, Manhattan DA Alvin Bragg has been hinting that rumors of the demise of his criminal case may be premature.

2. Did Trump violate presidential commitments? The fraud spans ten years, from 2011 thru 2021 – including the years when Trump supposedly gave his sons complete and total control to avoid any conflict of interest. Yet the fraud continued throughout his term in office. It will be interesting to see whether any suggestion he violated his commitments surface. Keep in mind, what he agree to do to avoid a conflict of interest wouldn’t have passed muster win any other administration, where elected officials routinely use blind trusts to avoid even the appearance of impropriety. (Pg. 8/222 of the complaint).

3. Father of the Year. AG James names names, noting in the opening paragraphs of the complaint that Trump himself, Eric and “one of his trustees” signed off on false financial statements. This is very direct and seems to put Eric the most at risk of the three siblings. What kind of parent leaves his kids to certify what he knows is a false statement that could put them at risk of prosecution? (Pg. 10/222)

4. Calling all loans. Come in, loans. The type of material misrepresentations in Trump’s financial statements are defaults under the loans. If those, or similar loans are still being repaid, the complaint appears to put the loans in default. Will Deutsche Bank and other lenders assert their rights? Call the loans? Often, the default only has an effect if the lender gives notice, so I’m looking to see whether this happens. If it doesn’t, why not? It could be a calculated move designed to preserve Trump’s solvency so he can continue to make payments, but it would still be extraordinarily special treatment. (pg. 16/222)

5. Hiding in plain sight. Also of interest, James alleges that “even after almost two years of litigation it appears that it may still be the case that not all responsive documents were produced by Trump.” Echoes of Mar-a-Lago. Trump had his lawyer represent to the New York Attorney General that they had “diligently searched each and every room of Respondent’s private residence located at [wait for it….] Mar-a-Lago, including all desks, drawers, nightstands, dresser, closets, etc.,” but didn’t find any responsive documents.” I wonder if the lawyer saw any classified material while conducting the search for the New York AG? It mentions places the FBI ultimately recovered sensitive materials from. Seems strange. (pg. 205/222)

I’ll continue to watch the proceedings in this case with great interest and flag developments for you.

And finally, in chicken news, we have names! Many thanks to those who suggested Butterscotch. Our daughter, in her typical fashion, deconstructed it into two names and we now have Butter (the blue one) and Scotch (the buff/red chicken). I really enjoyed all of your suggestions! They were great and I could have named an entire flock with them. Hopefully Butter and Scotch will grow up to lay lovely eggs (although Butter has some big rooster energy going on even at this early stage) and distract us with their antics when the coming elections gets too intense. Thanks for the assist!

We’re in this together,

Joyce

I taught tax accounting at the undergraduate and graduate levels for more than 35 years (Ph.D accounting). Fraudulent financial statements led to loans being granted that may not have been granted otherwise, lower interest rates, insurance policies being written that may not have been written otherwise, lower insurance rates, and then deflating the FMV of assets for purposes of lower property and other taxes. There are victims in these cases, just not in the sense that we're used to thinking about victims. This is not just FPOTUS inflating his statements to get higher up on Forbes list of billionaires. He, and all others involved, purposefully lied on these statements, in a most brazen way, to gain financial benefits. I'm not an expert on NY city and state business taxes, but it's possible that this scheme also lowered city and state taxes in addition to state property taxes. This could have also affected their federal taxes. And, keep in mind, all FPOTUS entities are flow throughs which means the entity generally doesn't pay tax, the owners pay it. Fraudulent statements affect not only the entities involved, but also the owners at the city, state and federal levels.

How many customers paid higher interest and insurance rates because of the lower rates FPOTUS arranged? How many people in NY did not receive state sponsored benefits because FPOTUS paid too little in taxes? FPOTUS intentionally issued non-audited financial statements because he'd never have gotten away with this if he had audited financial statements. I also have questions about Mazars since, even if you're doing a compilation, you're supposed to compare the current year with the past year to see if anything is "out of wack". There should have been a lot of questions about the constantly increasing values of the assets. Our systems only work if everyone attempts to follow the rules. When certain individuals and entities are allowed to flaunt the rules everyone in the system suffers.

Thank you for pointing out the absurdity calling people in their late 30’s to early 40’s “children”. I note that this is often done by trump sympathizers who deny the same protection to Hunter Biden whom they claim to be a shiftless criminal. All four of these persons are ADULT!